*2025 07 29 Claude Code On Cheap UK Stocks

I’m supposed to be building a simple CLI but I just can’t help but be distracted by the possibilities of doing quick work with Claude Code.

Saw some mentions of cheap UK stocks on twitter - I think greggs - while not interested in it per se, I have been seeing a lot of UK stocks pop up on my radar.

Despite all the issues that I’ve had with claude code: see this thread here - i do think this will be a decent use.

- UK has easy filings access.

- UK filings are relatively short - def don’t have many that go beyond 100 pages.

Given this, I think a lot of the issues I was having before do not apply.

I could also run this workflow in the background while I’m building out the CLI.

Let’s give it a go.

What do I want?

- The goal here is to get just enough information so I can find something that seems really mispriced. I plan to go through these with my webapp, taking notes along the way, so valuation / financial not necessary - I just want Claude to summarize / extract key information from key filings, as I would.

- Simple company description.

- Latest numbers - revenue, ebitda, ebit, eps. KPIs if there are any.

- Latest period results.

Testing with Single Company

Pulling this for a single company to see if it works / to refine the prompt.

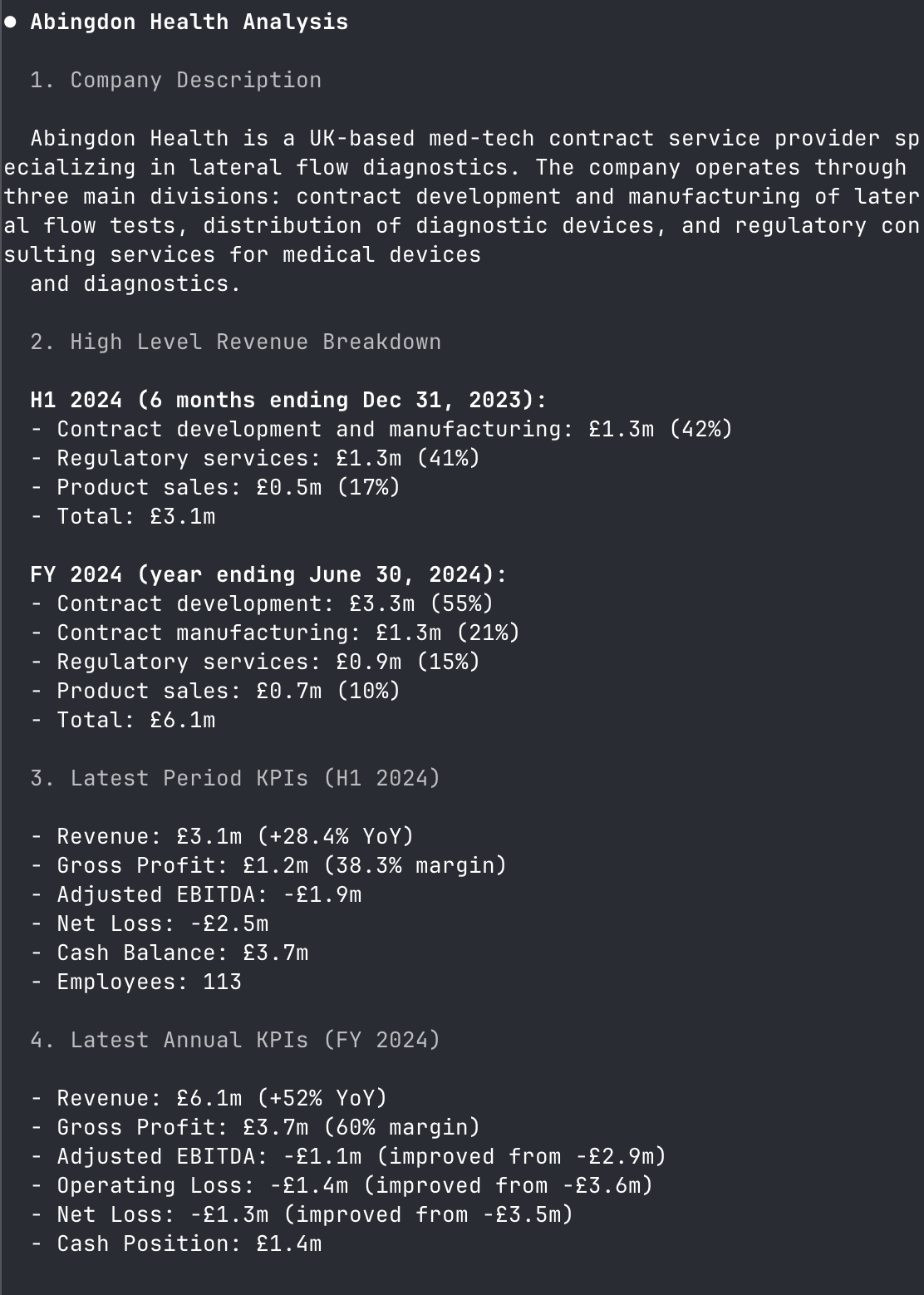

- It worked - but the result is not all that useful. Need to refine. Glad that I tested it with Abingdon, which is a more obscure / harder to understand business.

- What do I need from company description? I want something that I can skim, and get an understanding of what they do, and how they make money.

Fixing Prompts

Workshopped prompt using webapp for quicker iteration.

{@html `Generate a short report for Abingdon Health - based on the following template.

#### CLASSIFICATION|: Based on the description above, come up with 1) Sector, 2) Industry, 3) Sub-Industry classifications for the company. You may use more than 1 classification per each, but ONLY when it is ABSOLUTELY NECESSARY.

#### ULTRASHORT DESCRIPTION|: Describe the company in less than 15 words.

#### ENGAGING DESCRIPTION|: Create a cohesive, overarching profile of a company that focus on the company's key customer groups, core value proposition and business model. Make the descriptions ENGAGING, FUN and SUPER EASY TO READ while remaining SPECIFIC and DETAILED. Explain it like Matt Levine would in his newsletter, but dialled back and without using so analogies unless it is absolutely required. Since your readers are smart, you can introduce SOME technical terms of they are of high importance. Be objective - do not to regurgitate management propaganda. Do not be hyperbolic or overly effusive. Just tell it like it is.

Remember that the response should be super easy to SKIM for the reader. Use short sentences and short paragraphs of maximum 4 sentences.

#### REVENUE AND PROFIT BREAKDOWN|: Extract the business segments / division revenue and profit breakdown tables. Organize it into a single markdown table. If there are other supplementary revenue breakdowns, such as by revenue type, by product, etc - provide those as well

#### KPIs|: Extract available non-GAAP financials and KPIs for the latest periods. This can be ARR, MRR, Churn, ARPU, Same Store Sales, Booking, adjusted profit figures, etc.

Save the report in a {companyName}-report-{date}.md file.`}

Let’s see how Claude Code does with it. OK - I like the output.

{@html `# Abingdon Health plc - Company Report

## ENGAGING DESCRIPTION

Abingdon Health plc operates as a lateral flow test specialist that helps customers bring rapid diagnostic tests from idea to market. Think of lateral flow tests as those COVID-19 rapid tests everyone used during the pandemic - simple strips that show results in minutes. The company provides end-to-end services spanning development, manufacturing, and regulatory support for companies wanting to create these tests.

The business runs on a CRO/CDMO model - essentially acting as an outsourced R&D lab and factory for diagnostic companies. Customers come to Abingdon with a testing idea (say, detecting a specific disease marker), and Abingdon handles everything from initial development through regulatory approval to mass production. This integrated approach is their key selling point - most competitors only handle pieces of this puzzle.

Their customer base spans clinical diagnostics (both professional and self-tests), animal health, and environmental testing. Recent wins include developing sexually transmitted disease tests ($2m contract), malaria detection tests (£800k grant), and launching consumer pregnancy tests through major retailers like Boots. The company has facilities in York, UK and is opening a US site in Madison, Wisconsin to tap into the massive American diagnostics market.

Revenue comes primarily from contract services (89% in FY2024), with the remainder from selling their own branded self-tests. The recent acquisitions of regulatory consultancies CS Lifesciences and IVDeology significantly expanded their capabilities in navigating the complex approval processes for medical devices across different countries.

## REVENUE AND PROFIT BREAKDOWN

### Revenue by Segment (FY2024 vs FY2023)

| Segment | FY2024 (£m) | FY2024 (%) | FY2023 (£m) | FY2023 (%) | Growth |

|---------|-------------|------------|-------------|------------|--------|

| Contract Development | 3.3 | 54% | 2.3 | 57% | +45% |

| Contract Manufacturing | 1.3 | 20% | 1.1 | 26% | +19% |

| Regulatory Services | 0.9 | 15% | 0.3 | 7% | +236% |

| Product Sales | 0.7 | 11% | 0.4 | 10% | +56% |

| **Total Revenue** | **6.1** | **100%** | **4.0** | **100%** | **+52%** |

### Revenue by Geography (FY2024)

| Region | FY2024 (£m) | FY2024 (%) | FY2023 (£m) | FY2023 (%) | Growth |

|--------|-------------|------------|-------------|------------|--------|

| United Kingdom | 2.5 | 41% | 1.3 | 32% | +94% |

| USA & Canada | 2.0 | 33% | 0.8 | 21% | +137% |

| Europe | 1.2 | 20% | 1.7 | 41% | -26% |

| Rest of World | 0.3 | 6% | 0.2 | 6% | +47% |

### Financial Performance (H1 2025 vs H1 2024)

| Metric | H1 2025 | H1 2024 | Change |

|--------|---------|---------|--------|

| Revenue | £3.1m | £2.4m | +28% |

| Gross Margin | 38.3% | 53.0% | -14.7pp |

| Adjusted EBITDA Loss | (£1.9m) | (£1.2m) | -58% |

| Operating Loss | (£2.6m) | (£1.2m) | -119% |

## CLASSIFICATION

**Sector:** Healthcare

**Industry:** Healthcare Equipment and Supplies

**Sub-Industry:** In Vitro Diagnostics, Point-of-Care Testing, Lateral Flow Immunoassays

## ULTRASHORT DESCRIPTION

Lateral flow test developer and manufacturer providing end-to-end outsourced diagnostics services globally.

## KPIs

### Latest Period KPIs (H1 FY2025)

- **Contract Pipeline:** Multiple new contracts signed including $2m STD test development deal

- **Manufacturing Transitions:** 3 products moved to manufacturing in FY24 (Salignostics, LoopDX, Up Front Diagnostics)

- **Employee Count:** 113 (vs 85 at start of FY2025)

- **Cash Position:** £3.7m at Dec 31, 2024 (post-fundraise)

- **Geographic Expansion:** US facility opening April 2025

- **Regulatory Client Base:** Added 37 professionals through CS Lifesciences acquisition

### Operational Metrics

- **Revenue per Employee:** ~£72k (FY2024 basis)

- **Customer Concentration:** No single customer >10% of revenue

- **R&D to Manufacturing Conversion:** 3 successful transitions in FY2024

- **Time to Market:** Targeting 12-18 months from concept to commercial launch`}

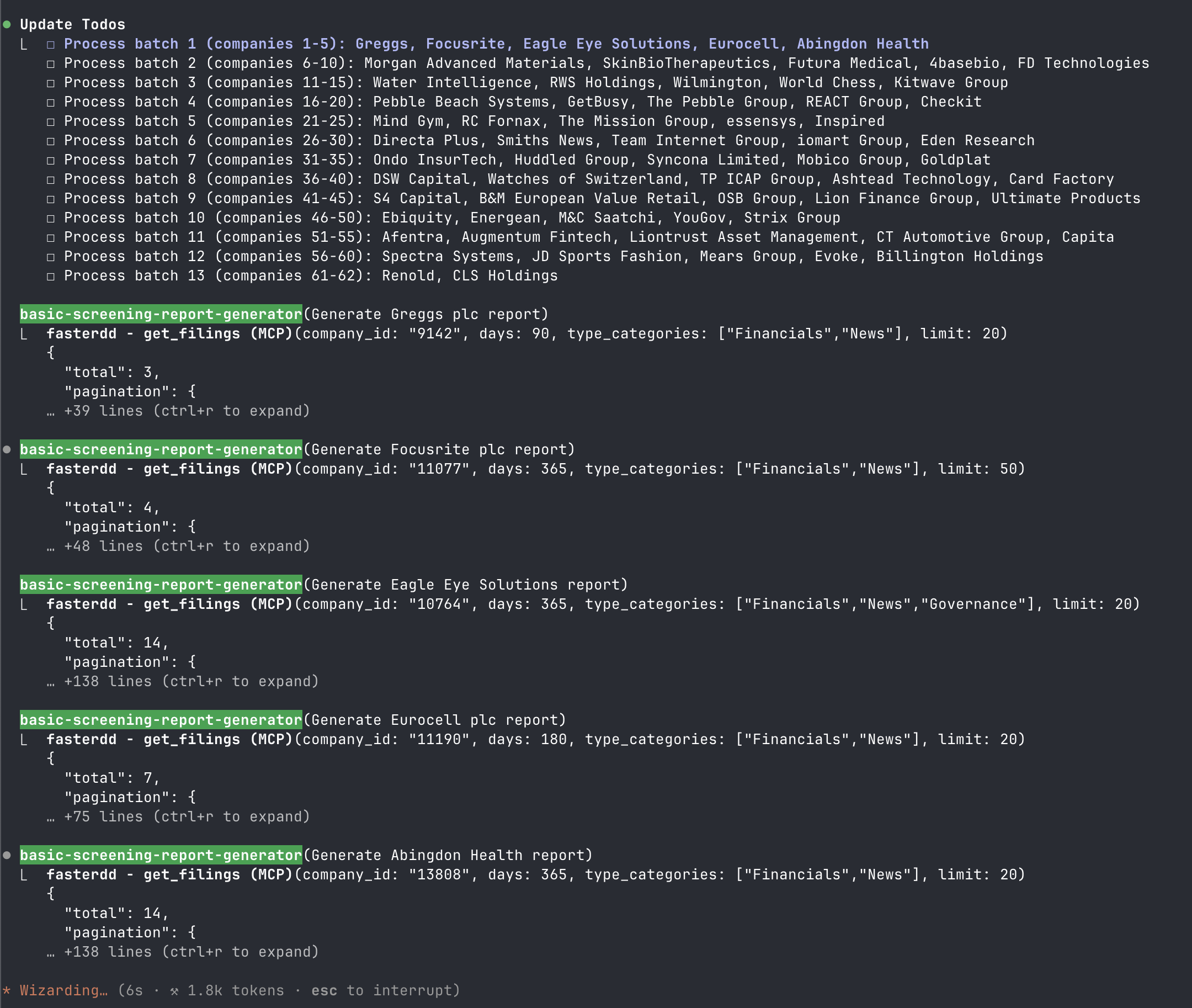

Let’s scale this up and how it does. Against my better judgment, I’m gonna run it on all companies, and let it decide how to run the show.

Scaled up run

First - quickly built up a watchlist of cheap UK stocks.

Letting claude loose on this list. And - we are in business. Will take a while to run so going to work on my CLI and come back to this.

5 minutes in - a few reports complete, but Claude trying to be lazy

Not today, soldier. But i did have to manually intervene. Maybe it’s a behaviour that I can prompt out.

Ah - OK it stopped out. I think partially because of context window. I need to farm out to subagents in order to do this properly.

Let’s check the report quality, and if good, create subagent.

Prompts v2 + Subagent

OK - so review of the results highlighted a few issues.

The description part works well - though it is on the side of being too effusive, it’s good enough for getting a first cut understanding of the business.

What isn’t working is the table stuff - instead of trying to extract bunch of specific tables, I think it’ll be better just to have the latest earnings results report.

Re-did the prompt.

{@html `

## CLASSIFICATION|: Based on the description above, come up with 1) Sector, 2) Industry, 3) Sub-Industry classifications for the company. You may use more than 1 classification per each, but ONLY when it is ABSOLUTELY NECESSARY.

## ULTRASHORT DESCRIPTION|: Describe the company in less than 15 words.

## ENGAGING DESCRIPTION|: Create a cohesive, overarching profile of a company that focus on the company's key customer groups, core value proposition and business model. Make the descriptions ENGAGING, FUN and SUPER EASY TO READ while remaining SPECIFIC and DETAILED. Explain it like Matt Levine would in his newsletter, but dialled back and without using so analogies unless it is absolutely required. Since your readers are smart, you can introduce SOME technical terms of they are of high importance. Be objective - do not to regurgitate management propaganda. Do not be hyperbolic or overly effusive. Just tell it like it is.

Remember that the response should be super easy to SKIM for the reader. Use short sentences and short paragraphs of maximum 4 sentences.

## LATEST RESULTS REVIEW:

Provide a summary of the company’s performance during this period in point form, with the following sections:

#### SEGMENTED FIGURES: Produce a markdown table that show revenue / profit performance breakdown by segment, geography, end customer industry, or product line, where available.

#### HEADLINE FIGURES: Produce a markdown table of revenue, adjusted profit, reported profit and EPS changes. Below the table, cite all organic growth figures, impact of acquisitions and disposals along with specific revenue / profit impact figures, and impact of currency movements, where available, with specific figures.

#### OTHER KPIs: Produce a markdown table that summarize changes in financial metrics and KPIs. In bullet form, define the KPIs, where appropriate.

#### OPERATING ENVIRONMENT: Extract and summarize comments on the broader industry and macroeconomic factors that influenced the company's performance during this period. This could include market trends, change in customer demand, competitive dynamics, regulatory changes, etc.

#### DISCUSSION OF KEY DRIVERS : Extract and summarize all of the key drivers of revenue and profit performance. Drivers mean reasons for the performance, not just some generic description of what happened.

#### MAJOR INITIATIVES: Outline any significant operational or strategic initiatives undertaken by the company, such as new product launches, acquisitions, restructuring efforts, etc. In addition, summarize any key initiatives, investments, or priorities discussed by management, as it relates to future revenues and profits.

#### GUIDANCE / OUTLOOK / FORECAST: Provide a summary of any statements regarding the future financial performance of the company.

Save the report in a {companyName}-report-{date}.md file.`}

Subagents also created.

Attempt no 2.

OK - let’s give this another go and see how it goes.

2:35PM

Annnd - we are stuck. I’m not sure if I’m out of credits or what - but I’ve been out for a few hours and the agent is stuck at Kitwave.

OK. Abandoning this entirely. It is good to generate a few reports, but there are just way too many problems